Who We Are

Pacific Peak Advisors is a boutique financial advisory firm dedicated to helping individuals, families, and business owners make confident financial decisions. With personalized guidance, decades of experience, and a commitment to your goals, we’re here to support every stage of your financial journey.

Our History

Pacific Peak Advisors is a boutique firm, originally organized by Robin Robertson. In 2012, Sean Kovich joined as partner, adding his expertise to the firm.

We work with our clients through their changes in life, from the birth of a first child through retirement and onward as they pass the reins to the next generation.

At Pacific Peak Advisors, we see clear communication as vital to our client relationship. Beginning with personal meetings, attentive customer service, and customized planning, we nurture each relationship and the trust we work so diligently to build.

We recognize that, for many of our clients, their children and grandchildren top their list of priorities. We offer free consulting to the children/grandchildren of our clients through age 25 for topics like: opening a first credit card, how to obtain a school loan, and how to start a first retirement account. With the dearth of financial education available to kids, we enjoy doing our part to be a resource for your whole family.

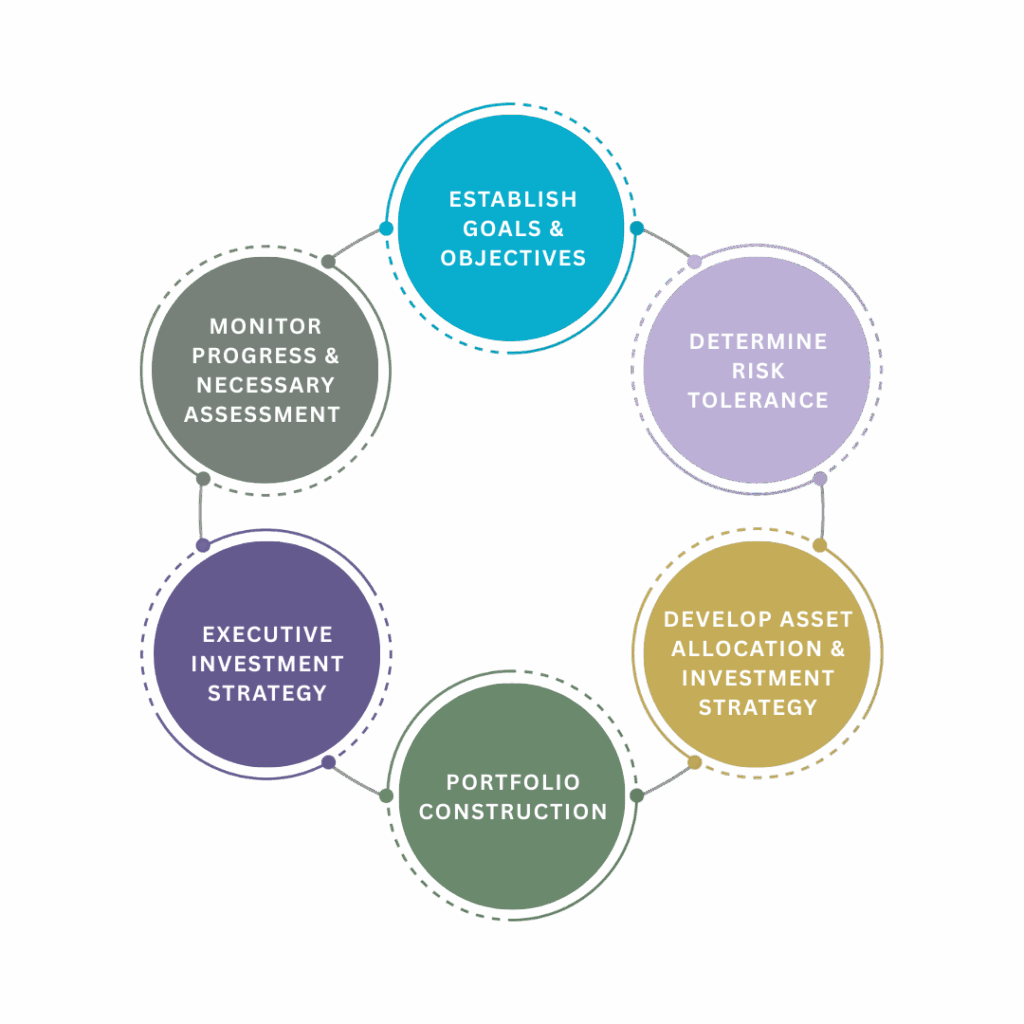

Our Process

We meet with each client and their close advisors initially to discuss family goals, retirement objectives, risk management, asset protection and personal objectives. We establish the priority list and then discuss the techniques available to achieve those goals and objectives.

Once this is complete, we prepare an analysis of the options available and discuss the pros and cons of these options. We model the techniques numerically so the client can see the exact result of each potential solution.

Once an action plan is decided on, we assist with the implementation of the solutions selected and follow through to their completion. This might include family meetings, advisor meetings, interfacing with trust companies, etc.

We review all our plans as necessary and hold family meetings to make sure we are up to date on concerns and issues.

Plan - Everything starts with a plan

Planning is the gateway to what is possible. It is our belief that every family, large or small, should have a financial plan. Each of our clients gets one at no additional charge. A plan is the first step in our ongoing relationship and the framework for how we make decisions. It all starts with the most essential questions. What is important to you?

Access

Manage and track your assets efficiently

-

Access to the ‘Pacific Peak Toolbox’ Mobile account viewing

-

Visa debit card

-

Check writing

-

Wire transfers

-

Electronic funds transfer service

Save

Prepare for the retirement you envision

-

Traditional IRAs

-

Roth IRAs

-

IRA rollovers

-

Fixed rate annuities

-

Variable annuities

Grow

Access investments that align your objectives with your goals

-

Equities Taxable fixed income

-

Non-US equities and fixed income

-

Municipal bonds

-

Open-end mutual funds

-

Exchange traded products

-

Precious Metals

-

Market-rate CD's

-

Real estate investment trusts

Protect

Help safeguard your family and future

-

Elder care planning

-

Social security

-

Medicare Life insurance

-

Long-term care insurance

-

Disability income insurance

Give

Create a Legacy

-

Charitable gift annuities

-

Strategic giving advice

-

Family advisory services

-

Next generation giving

-

Giving through trusts

Plan - Everything starts with a plan

Planning is the gateway to what is possible. It is our belief that every family, large or small, should have a financial plan. Each of our clients gets one at no additional charge. A plan is the first step in our ongoing relationship and the framework for how we make decisions. It all starts with the most essential questions. What is important to you?

Access

-

Access to the ‘Pacific Peak Toolbox’ Mobile account viewing

-

Visa debit card

-

Check writing

-

Wire transfers

-

Electronic funds transfer service

Save

Prepare for the retirement you envision

-

Traditional IRAs

-

Roth IRAs

-

IRA rollovers

-

Fixed rate annuities

-

Variable annuities

Grow

-

Equities Taxable fixed income

-

Non-US equities and fixed income

-

Municipal bonds

-

Open-end mutual funds

-

Exchange traded products

-

Precious Metals

-

Market-rate CD's

-

Real estate investment trusts

Protect

-

Elder care planning

-

Social security

-

Medicare Life insurance

-

Long-term care insurance

-

Disability income insurance

Give

-

Charitable gift annuities

-

Strategic giving advice

-

Family advisory services

-

Next generation giving

-

Giving through trusts

Our Team

Our team at Pacific Peak Advisors brings decades of experience, deep industry knowledge, and a personal touch to every client relationship. Led by Robin Robertson and Sean Kovich, we pride ourselves on clear communication, thoughtful planning, and a commitment to helping you reach your goals—now and into the future.

Robin J. Robertson, CLU

PRINCIPAL / SENIOR FINANCIAL ADVISOR: PACIFIC PEAK ADVISORS

Robin Robertson, principal of Pacific Peak Advisors, has been in the financial services industry for over 30 years. She started her practice in CA with business owners and high net worth individuals helping them build retirement and investment plans. The practice has grown, expanding into Colorado, Idaho and Texas. Robin and Sean moved the offices to Ketchum Idaho in 2019 to enjoy the mountains and fresh air. Both she and Sean travel to California where they maintain homes to visit with their California clients. Robin has developed a strong relationship with the PPA clients over time working with them through their life changes and getting to know their families. Our boutique firm structure is designed for ample time to meet with and guide each client personally.

Robin’s passions are skiing, golfing, hiking, reading, travel, cooking and her family.

Sean Kovich CFP® ChFC® CLU®

CIO / FINANCIAL ADVISOR: PACIFIC PEAK ADVISORS

Sean’s background, education and experience come together to provide independent and objective counsel as he works with clients to determine their goals and how to best achieve them. This includes comprehensive financial planning, a cost/benefit analysis of client risks, and ongoing reviews to track progress towards each client’s stated goals. As a Certified Financial Planner, Sean brings a unique qualitative perspective and passion for collaborative research and analytics, which helps him to comprehensively manage clients’ wealth.

Sean started in the financial services industry in 2005, earned a B.A in financial Services from San Diego State in 2008, and has continued to develop his knowledge of the industry by obtaining the CFP®, ChFC® and CLU® designations. He lives with his wife Heather and four animals in Hailey, Idaho. In his spare time, he enjoys snowboarding, backpacking and playing bass guitar. Sean also holds a blue belt in Brazilian Jiu-Jitsu and is a volunteer firefighter for the city of Sun Valley.